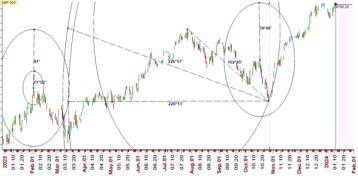

If I tell you, a down move is coming up in s&p, exit your long positions in s&p or short s&p.

Does it make any sense?

For me, it does not make any sense because, on the basis of it, I can not trade.

To enter a trade, I need the price at which I can book profit in my longs and simultaneously go short.

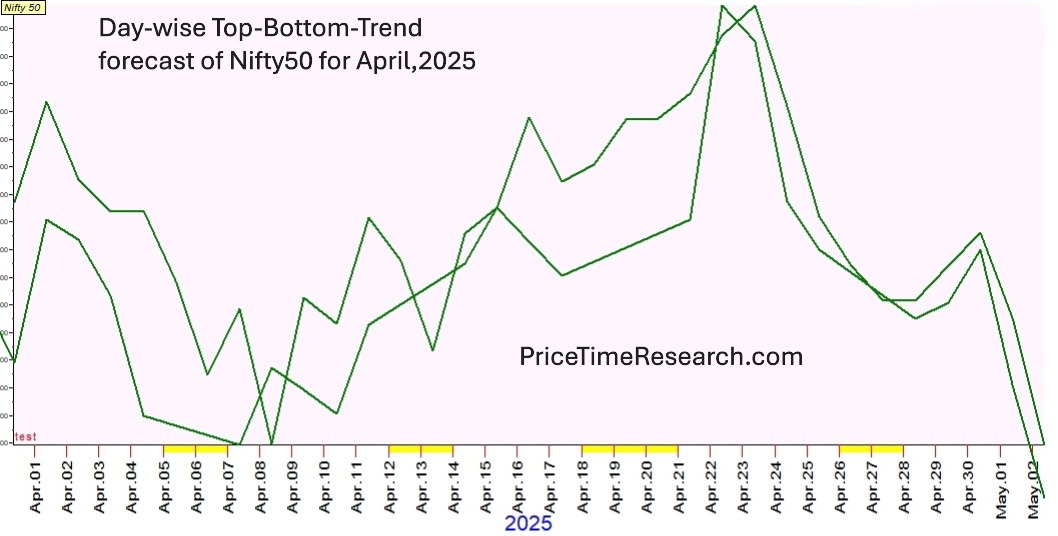

I also need the date when this expected down move will start in S&P.

This date is very important for put option traders.

Without knowing the price and time, if I buy put options on S&P, I will get dangerously trapped, and all my premiums can go to zero.

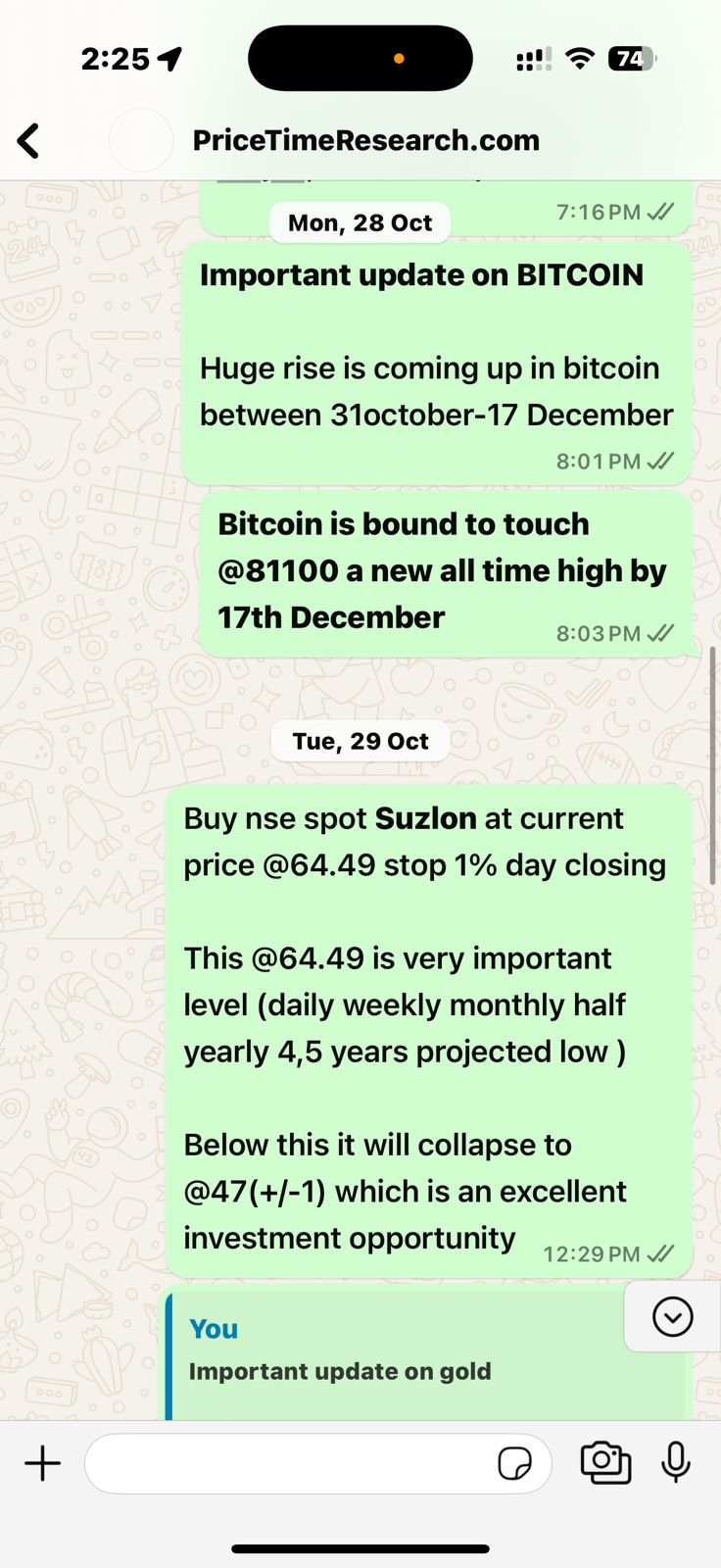

But if I tell you to short S&P March futures on January 25th (2nd most ideal date) at 4925 (+/-20) stop 1 point day closing basis @4946, does that make any sense?

I hope you find our research useful.

best wishes