*Is it possible to predict the time window of the next spike up in VIX (S&P)”?

The answer is yes.

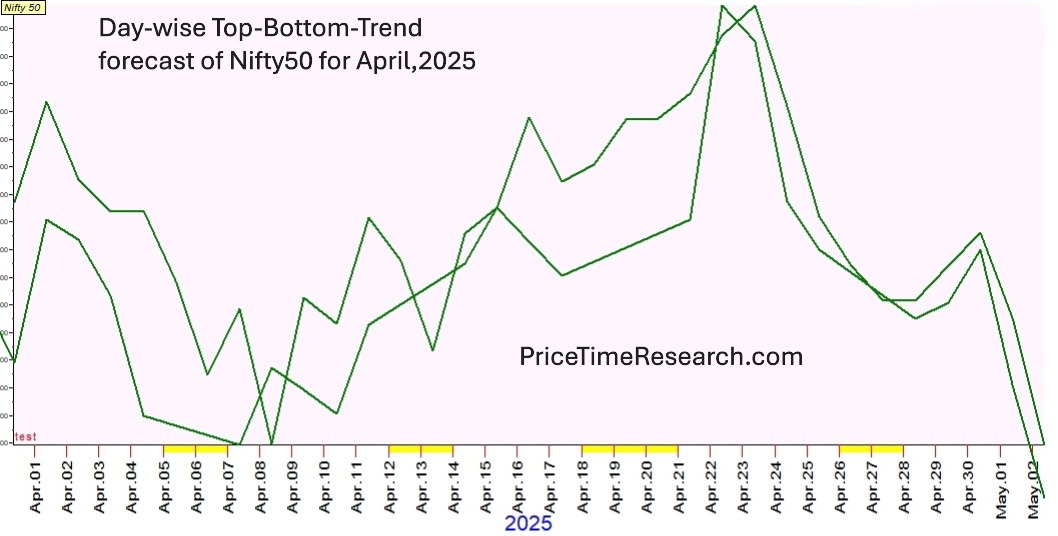

Today Instead of astrological trend-top-bottom, I’ll share a cycle analysis of VIX.

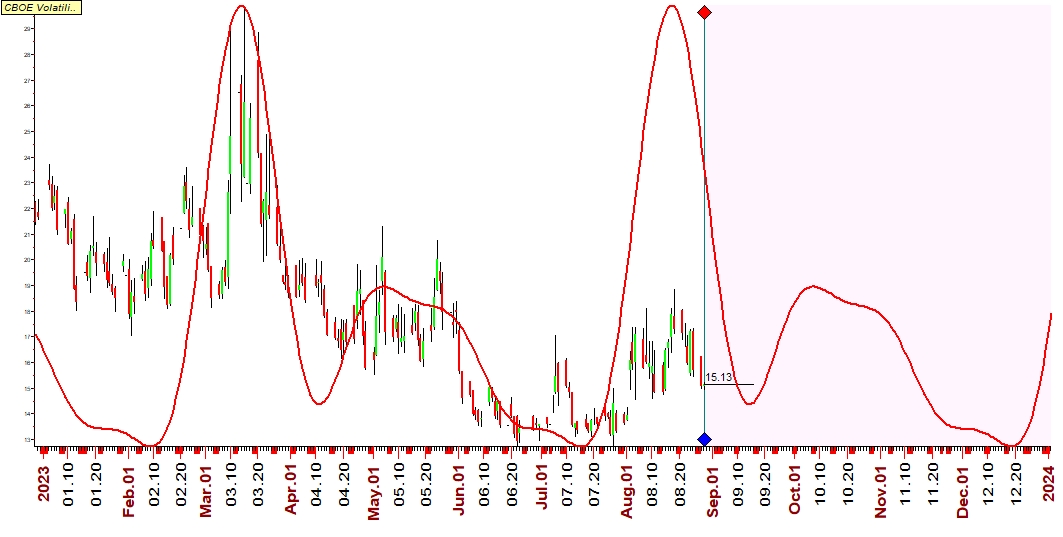

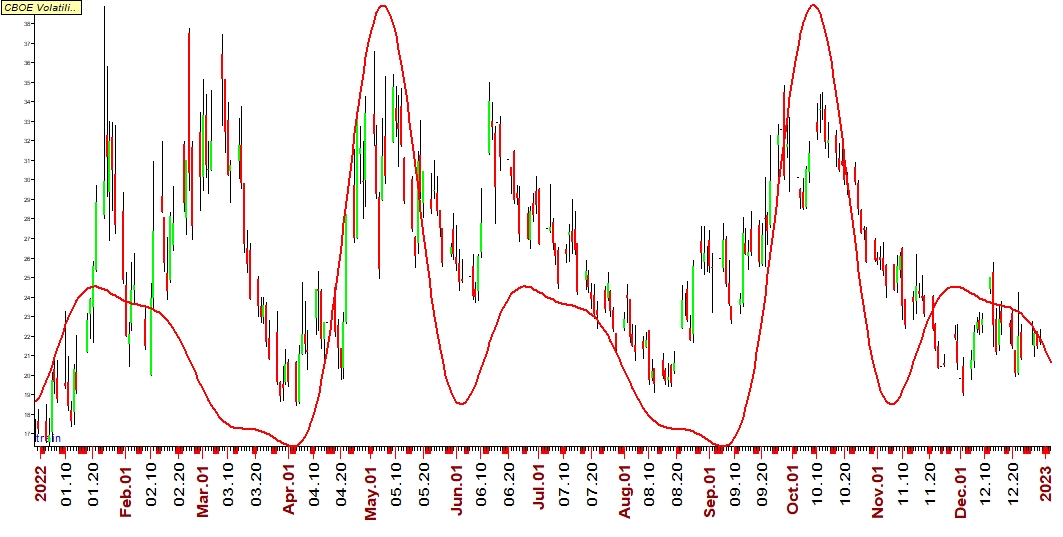

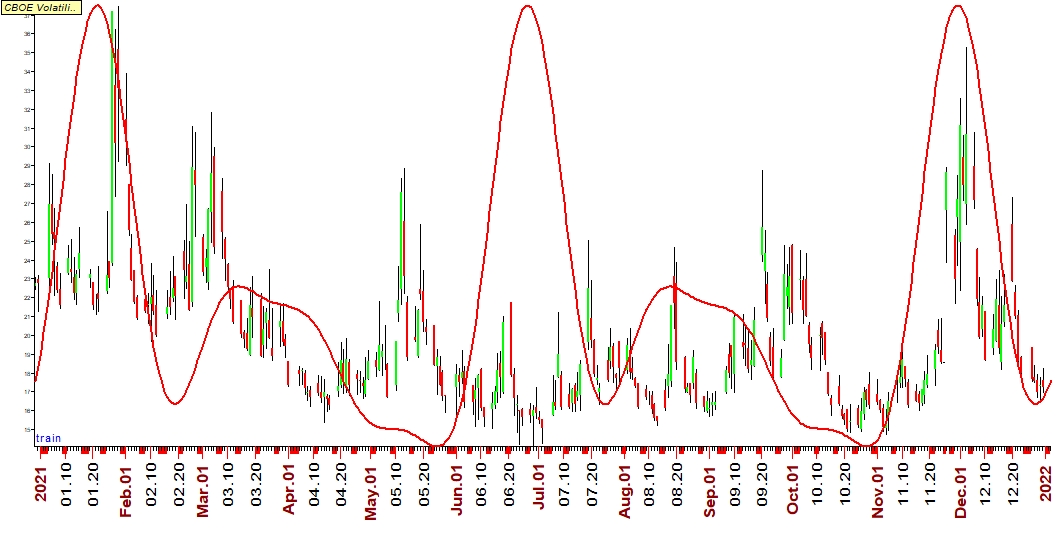

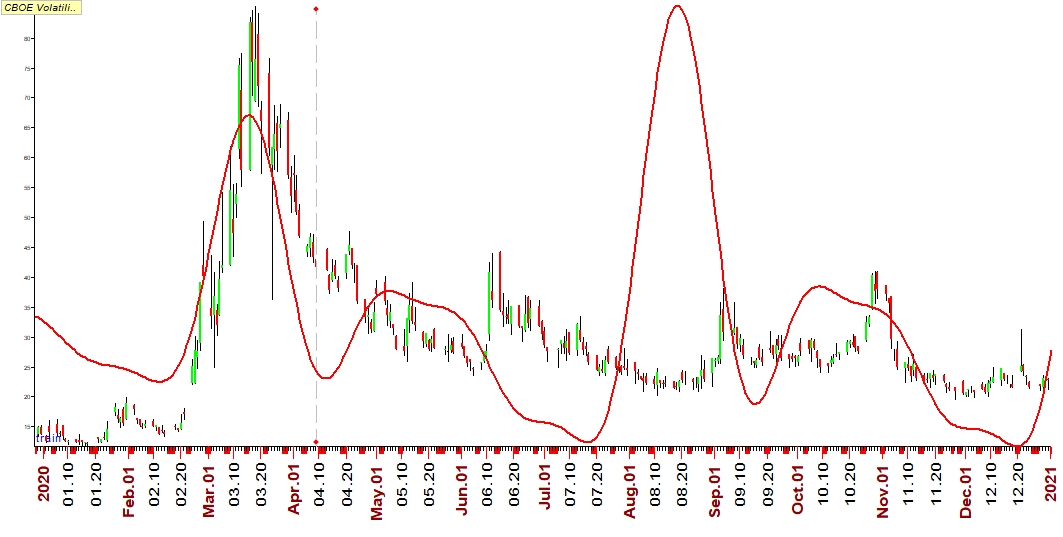

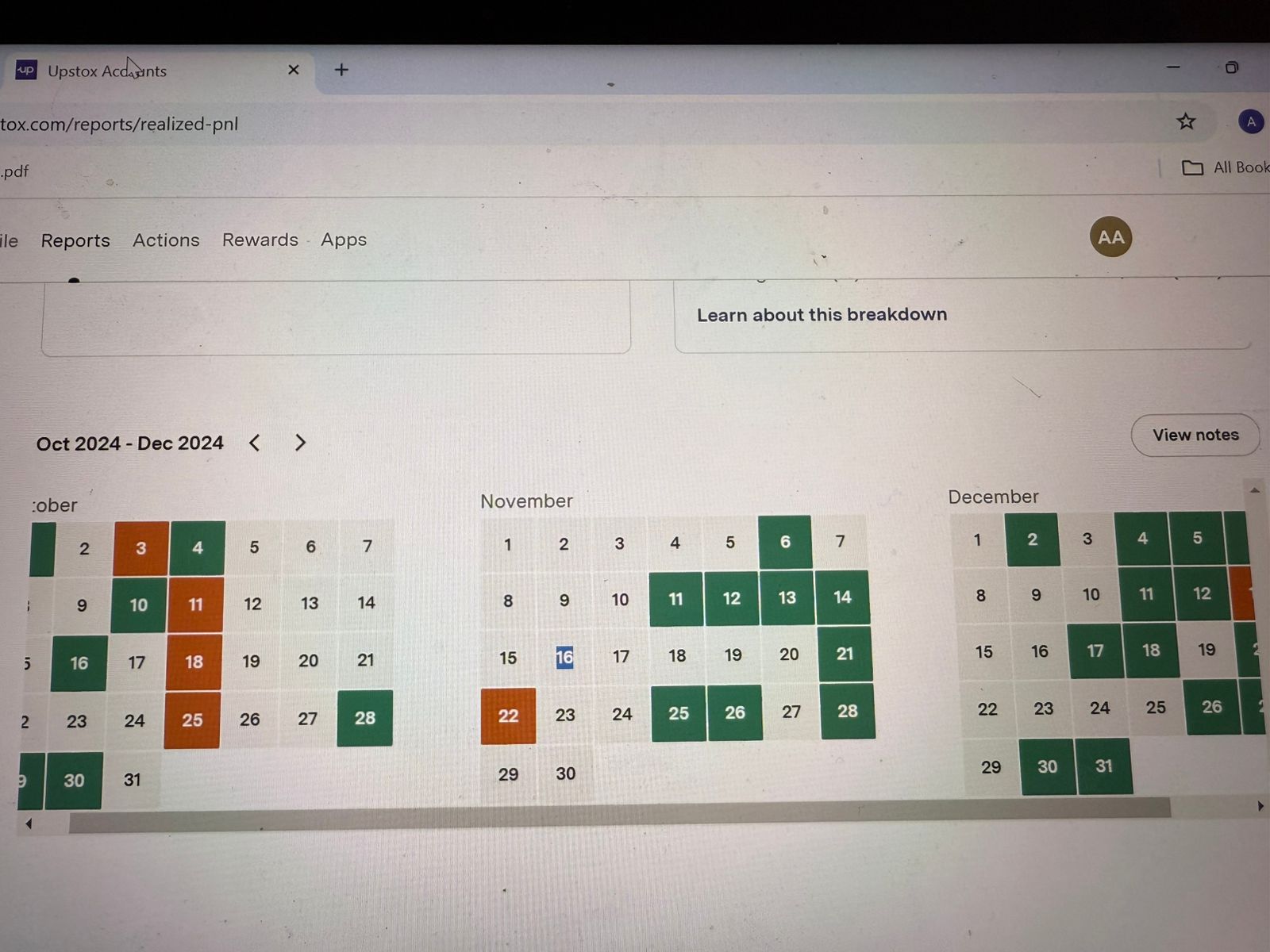

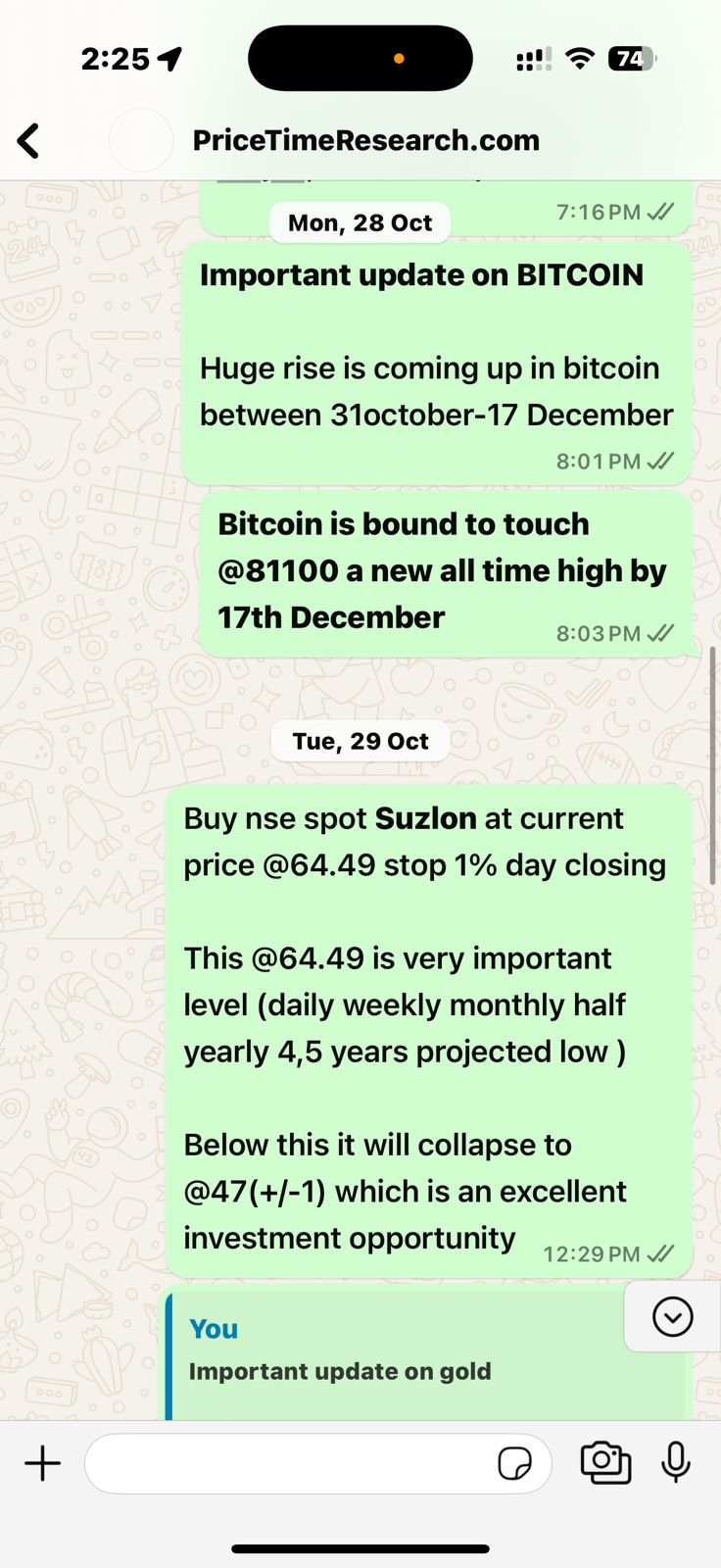

First, I’ll share a comparative analysis (real-time vs. forecast) of the last 4 years to show you how beautifully this cycle is working year after year.

By looking at this, we will also have an idea of when we can expect the next spike in VIX.

Every asset is dominated by a particular cycle, and similarly, the volatility index of the S&P 500 is also dominated by the ***-day cycle (this is a permanent cycle). A permanent cycle is one cycle which dominates the relevant asset for its lifetime.

A few years ago, I shared this ***-day cycle analysis of VIX.

I generally don’t use cycle analysis because they are not precise, but in VIX, cycle analysis is useful because we are more keen to know the time window of the next spike up than a day-wise trend forecast.

As you can see, this ***-day cycle is working nicely in VIX. For precision, along with this, we will use the astrological trend-top-bottom forecast, which I share every month.

I hope you find our research useful.

best wishes